The Future of Green Gas: How European Biogas is Revolutionising Corporate Decarbonisation

Introduction: Why green gas matters now

Corporate decarbonisation has a major blind spot: heat. Across Europe, factories, chemical plants, food processors and hospitals still depend heavily on fossil gas. While electrification grabs headlines, the reality is that high‑temperature heat and combined heat and power (CHP) loads often cannot be easily switched. The costs of new infrastructure, the limits of electricity grids, and the need for operational reliability mean many businesses are stuck.

That is where biomethane, commonly called green gas—comes in. Chemically identical to fossil gas, biomethane can be injected into existing gas grids or delivered directly to sites. It offers companies a practical, immediate pathway to cut Scope 1 emissions without tearing out boilers or investing in disruptive retrofits. In effect, it lets businesses decarbonise today while planning for the longer‑term shift to more electrified systems.

A rising corporate appetite

The corporate demand for biomethane is accelerating rapidly. With the EU Emissions Trading System tightening and free allowances being phased out, every tonne of fossil fuel burned has a higher price tag. At the same time, energy security concerns since the Ukraine conflict have driven companies to diversify away from imported fossil fuels. Layered on top are ambitious net‑zero commitments, which have become standard across multinational corporations. Together, these forces are creating a wave of demand for alternatives that can deliver real Scope 1 reductions.

Biomethane is particularly attractive because it is a drop‑in fuel. Companies can switch without expensive modifications to their CHP engines, boilers or dryers. The gas can be transported through existing infrastructure, meaning production and consumption can take place in different regions, with certificates ensuring traceability. Perhaps most importantly, biomethane reflects the principles of the circular economy, converting food waste, agricultural residues, and livestock manures into renewable energy while simultaneously producing nutrient‑rich digestate for agriculture.

For companies facing pressure to cut emissions without compromising operations, biomethane offers a pragmatic balance: scalable, credible, and already available.

Untangling the carbon accounting puzzle

Despite its promise, the use of biomethane in corporate carbon accounting has been controversial. Until 2020, companies purchasing green gas certificates could claim zero emissions in their Scope 1 reporting. Since then, however, changes to the Greenhouse Gas Protocol guidance have cast doubt over whether certificates can be used in this way, creating uncertainty for buyers and investors.

The European Biogas Association has stepped in with its “Let Green Gas Count” initiative, setting out six core principles to maintain integrity while the rules evolve. These cover unique claims, strict tracking and retirement of certificates, transparent production data, clear market boundaries, chain of custody, and independent verification. Together, these guidelines aim to provide a bridge until the GHG Protocol completes its review.

For corporates, the message is clear: biomethane can already be part of your decarbonisation strategy, provided it is backed by credible certification and rigorous documentation. Dual reporting—showing both location‑based and market‑based emissions—remains best practice to demonstrate transparency.

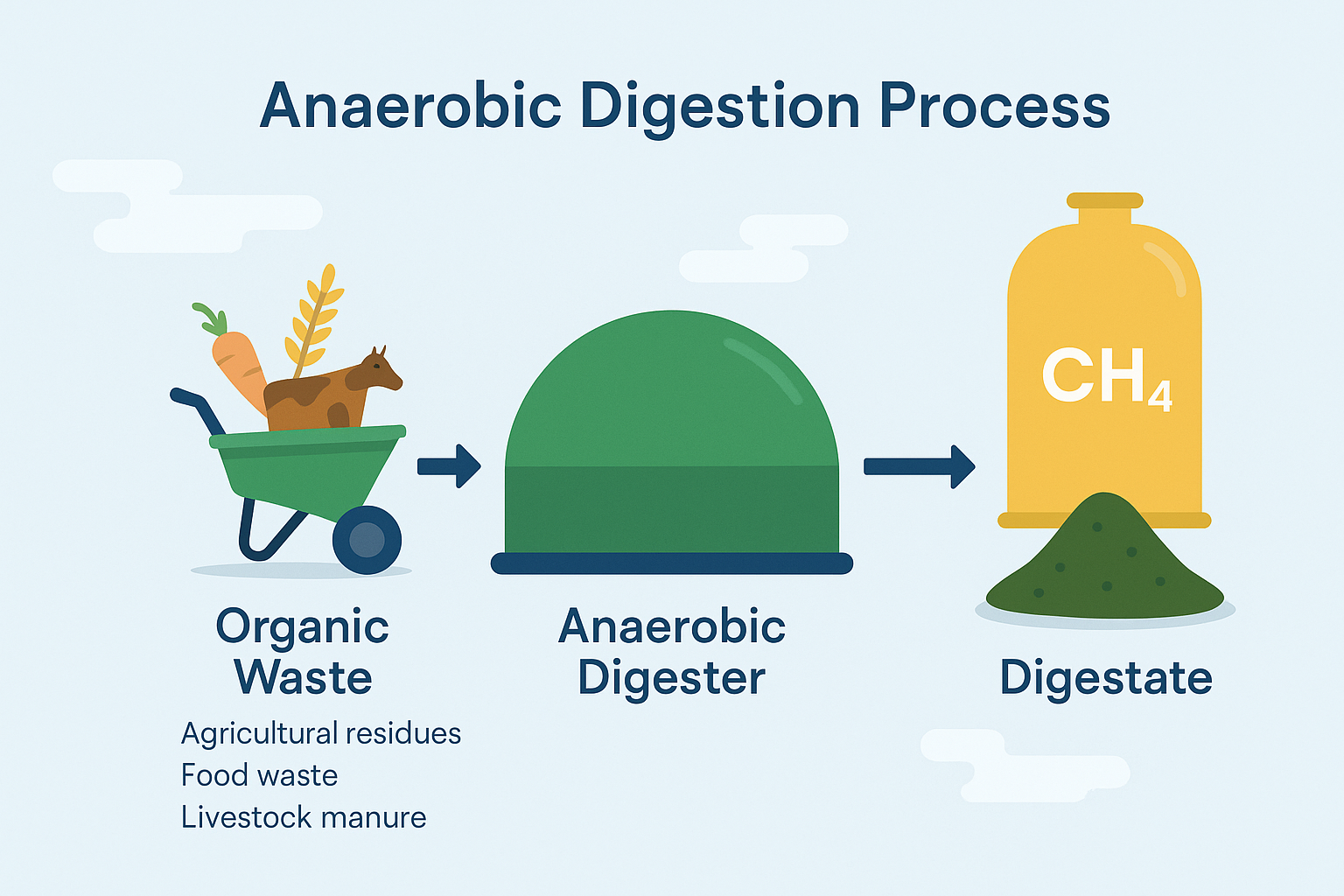

Biomethane 101: turning waste into energy

At its core, biomethane production is a story of waste turned into value. Through anaerobic digestion, organic matter is broken down without oxygen, producing a biogas mixture of methane and carbon dioxide. When upgraded to remove the CO₂ and impurities, this gas becomes biomethane, meeting the same quality standards as fossil natural gas.

The environmental benefits are significant. Capturing methane from slurry lagoons or landfill sites prevents potent greenhouse gases from escaping into the atmosphere. Every cubic metre of biomethane injected into the grid displaces fossil gas, cutting emissions directly. And the digestate by‑product closes the nutrient loop by returning fertiliser to soils, reducing reliance on energy‑intensive synthetic alternatives.

For industrial users, biomethane’s advantages go beyond carbon savings. It is dispatchable, offering reliability when solar and wind are unavailable, and it is fully compatible with existing gas infrastructure. In short, it is renewable energy tailored for heat and CHP.

Market growth and investment momentum

Europe’s biomethane market is growing, though the pace is starting to slow. Production capacity in 2025 stands at around 7 billion cubic metres per year, supported by more than €28 billion in committed investments.

However, achieving the EU’s REPowerEU target of 35 bcm by 2030 will require a five‑fold scale‑up in just five years. Policymakers and investors alike are pushing for stronger market signals to sustain momentum.

For corporates, this context matters. Competition for volumes is intensifying. Early movers are already securing long‑term offtake agreements, locking in both supply and price stability. Costs currently range from €55 to €130 per MWh, depending on feedstock, project scale and national support schemes. Waste‑based projects often command higher premiums, but they also deliver stronger ESG narratives—an increasingly important factor for investors and stakeholders.

Certificates and chain of custody: proving your claims

Buying biomethane is not just about fuel, it is about credibility. Certificates, such as Renewable Gas Guarantees of Origin (RGGOs) in the UK or Guarantees of Origin (GOs) across the EU, provide the chain of custody needed to demonstrate that your claimed consumption is real, unique, and verifiable.

A robust system involves three stages: issuance of one certificate per unit of biomethane produced; secure transfer through trusted registries; and retirement to prevent resale. Evidence pack covering contracts, registry statements, and sustainability certificates, complete the process and ensure audit readiness.

Schemes such as the Green Gas Certification Scheme in the UK or ERGaR’s cross‑border registry cooperation are central to building confidence. For corporates, treating certificates with the same care as financial instruments is the best way to avoid reputational risk.

Procurement pathways for corporates

There is no single way to buy biomethane, and the right pathway depends on your business profile. For companies seeking a rapid start, purchasing certificates alone is the simplest route. Medium‑to‑large energy users can opt for grid‑injected supply combined with certificates, offering stronger audit trails. For sites with large, consistent energy needs, on‑site or near‑site AD plants can provide direct supply and energy security, though this comes with significant capital investment and operational responsibilities. Meanwhile, logistics companies are increasingly turning to bio‑LNG as a solution for hard‑to‑electrify transport.

The common thread is flexibility. Corporates can begin with low‑commitment certificates, then scale up to more strategic procurement as volumes and tenors justify it.

Economics and risk management

Biomethane pricing is influenced by feedstock availability, plant scale, grid fees and policy support. For corporates, treating biomethane procurement like any other strategic commodity is essential. Blending short‑term and long‑term contracts, indexing against gas hubs, and embedding performance clauses into agreements can provide both cost certainty and resilience.

Crucially, biomethane also acts as a hedge against rising carbon costs under the EU ETS. For companies with science‑based targets, it offers a way to credibly decarbonise Scope 1 emissions today while keeping future options open.

Real‑world examples

Several corporates are already proving biomethane’s value. A food manufacturer operating across the UK and EU has shifted 40% of its process heat load to biomethane through grid‑injected supply and certificates, achieving payback within 18 months when measured against its internal carbon price [1]. A pharmaceutical campus in Germany began with certificates to meet immediate targets, then invested in a near‑site AD plant using local waste feedstock, forecasting up to 70% Scope 1 reductions at site level. [2] Meanwhile, a logistics company has transitioned part of its long‑haul fleet to bio‑LNG, cutting emissions intensity by 75% compared with diesel.[3]

These examples underline a clear lesson: start with what is accessible, prove the accounting, and then scale up to long‑term, strategic procurement.

The policy horizon

The next few years will be pivotal for biomethane. The GHG Protocol is expected to provide greater clarity on the treatment of certificates in Scope 1 reporting. The EU continues to prioritise biomethane within its energy security and decarbonisation agenda, while national schemes like the UK’s Green Gas Support Scheme provide financial support for new projects. RED II and III sustainability rules will further shape how projects are designed and certified.

For corporates, these evolving policies represent both a challenge and an opportunity. Those that engage early, understand the nuances, and build robust procurement systems will be best positioned to demonstrate leadership.

FAQs

Is biomethane zero emissions?

Not exactly. Burning biomethane releases CO₂, but it is biogenic and part of the short carbon cycle. With valid certificates, companies can credibly claim Scope 1 reductions on a market‑based basis. Dual reporting remains recommended.

Can small sites participate?

Yes. Multiple smaller facilities can be aggregated within boundaries, provided consumption is matched and certificates are retired correctly.

Is there a risk of double counting?

Yes, unless certificates are carefully managed. That is why unique issuance, secure transfers, and exclusive retirement are essential.

Does biomethane help with energy security?

Absolutely. It turns local waste into local energy, reducing dependence on imports.

What if electrification becomes cheaper?

Electrification and biomethane are complementary. Electrify where possible, use biomethane for heat and CHP where it delivers most impact.

How BIOCON can help

BIOCON Group provides end‑to‑end expertise across the biomethane value chain. From strategy and procurement design to environmental permitting, engineering delivery and operational optimisation, we help businesses adopt biomethane with confidence. Our teams also support evidence packs and audit preparation, ensuring your claims stand up to scrutiny.